Statutory audit: a critical analysis

Auditisadng is a major part of the accounting function for a healthy business. There are different types of auditing, but it basically entails reviewing the numerical aspect related to the business functions. By numerical, it means monetary. Whatever function, department or operation which involves a monetary inflow or outflow is audited to review if it is ideal for the company, and to assess the consequences for the firm in the longer term. Statutory Audit involves a holistic analysis of the financial statements of the business.

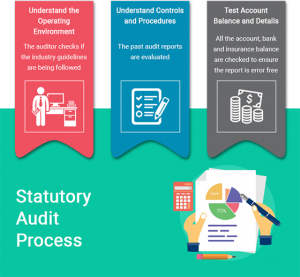

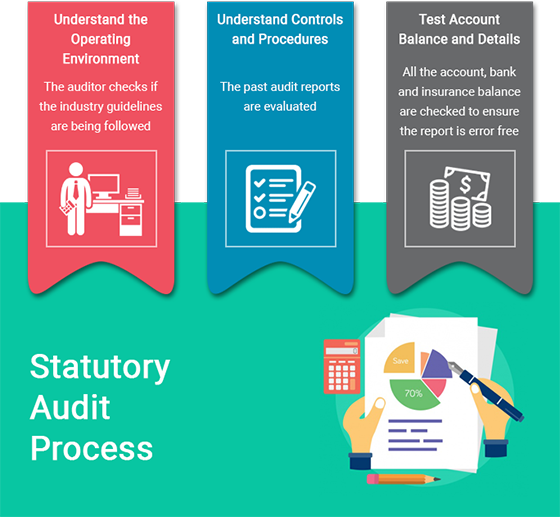

Many firms and auditing companies offer their services for statutory audit in Dubai, Statutory audit in Bahrain and Statutory audit in the UAE. The statutory audit procedure may be different for different firms, but the main expected outcome out of it is to verify the financial statements of a business so that externals and any third party interested to do business with them can depend on that audit report to confirm their financial standing. It is a required report by many governmental bodies, as to have clarity of the business positions of a firm. Not to confuse internal audit and statutory audit, as the former is an internal function and carried out on the firm’s own choice and decision, while the latter is a statute mandatory for most companies by their governing bodies.

A non-statutory audit however, is done without any necessary mandate from the government, but to analyze the financial statements and pick out and hurdle causing activities that might hinder the business operations, affecting the profit margins or other Key Performance Indicators (KPIs).

Auditing and financial reporting firms conduct statutory audit of banks and statutory audit of companies that approach them for the purpose. The reports are then made available publicly, except for closely held companies, so that other external parties can have access to the company’s financial information. Quantum Auditing provides these services with the utmost precision and accuracy. We make sure your provided data is reviewed honestly and with professional validity, so that it helps your business in its growth, and taking measured steps towards improving business operations. This might include boosting certain activities and cutting off on some, whatever the audit exercise suggests.

When trusting an external auditing firm, you need to make sure of their credibility and how much you can rely on them not only because they have a very important role to perform for the business, but also because an auditor gets access to important and confidential data that is not to be shared with just anybody. While selecting an external auditor one should always keep these facts in check. Quantum Auditing makes sure to uphold its dignity in the line of doing sincere business. You can read further information about statutory auditing services provided by Quantum Auditing here.